Square has no monthly fees and a low flat transaction rate. But is it safe? Find out if this credit card processor is good for business.

Build customized solutions that accept payments (online, in-person, or in-app), manage products and customers, and handle the day-to-day operations that keep business running.

- To use Square Cash, you have to be a resident of the US, and also physically present in the US. That means you can’t use it when you’re travelling or if you’re an expat and live abroad. If you’re planning on using Square Cash to make a payment, it’s also useful to note that the Cash app can’t be used in some US territories.

- Online and invoice processing fee: 2.9% + 30 cents; Card on File invoice processing fee: 3.5% + 15 cents; Swipe reader cost: free; Chip and tap reader: $49; Square Terminal: $299; Square Mobile Payment Features: POS app: You can use the free Square POS mobile app on both Android and iOS devices—even when offline. With the app, you can also.

Overall Score | 4.0 |

Price | 4.0 |

Customer Service | 3.0 |

Equipment | 5.0 |

Contract | 5.0 |

Ecommerce | 5.0 |

High Volume Business | 1.0 |

Low Volume Business | 5.0 |

Pros and Cons

- No monthly or annual fee

- Free swipe card reader

- Low, predictable fixed rates

- Flat-rate pricing can be expensive for larger businesses

- Costly add-on services

Bottom Line

Good credit card processor for low-volume businesses

- Who is Square Best For

- Square Pros & Cons

- Pricing & Other Fees

- Is the Square Reader Good?

- What You Get With Square

- Free POS App Features & Tools

- Additional Add-on Services

- Advanced Industry-Specific Plans

- Customer Service

- Is Square Safe?

You've probably seen their card readers at Girl Scout cookie stands and food trucks.

Why is Square so popular?

They're known for low costs and an easy setup. No contract required. The mobile reader is free and plugs into your phone or tablet. You could start swiping in minutes.

But Square isn't for everyone.

Take a look at the fees, features and types of businesses they're best for. Plus, see if other payment processors can offer you a better deal.

Who Is Square Best For?

Square is a good company for new or mobile businesses thanks to the low 2.6% + $0.10 per-swipe fee. Square has more free tools compared to other processors. But large high volume businesses should consider a dedicated merchant account.

- New companies: With no monthly fee and flat rates for all credit cards processed, Square is an affordable option for new businesses.

- Companies with small transactions: Because it's a fixed rate (2.6% + $0.10), small transactions remain affordable. For example, a $10 transaction would only cost you $0.37 (versus a $1,000 transaction, which would cost $26.10).

- Mobile businesses: Companies on-the-go need a simple payment processor they can use anywhere. Square's card reader can be plugged right into your phone or tablet.

Stop Overpaying on Credit Card ProcessingSelect your state for the

Square Pros & Cons

PROS:

- Low, predictable fixed-rate at 2.6% + $0.10 per swipe

- No monthly or annual fee

- No contract

- User friendly interface

- Free swipe card reader

- Free POS app

- Feature-rich all-in-one system

- Can accept offline payments

- Quick deposits within 2 business days

CONS:

- Weak customer support

- Costly add-on services

- Flat-rate pricing can be expensive for larger businesses

- High-risk businesses may not be accepted

Square provides more features for physical retailers. It has a more advanced POS with tools such as scheduling, employee, and inventory management.

PayPal takes the cake on eCommerce businesses. And one big advantage is the ability to accept PayPal payments. But it has limited functions for vendors on-the-go, making it more of a payment processor rather than a full POS.

Pricing & Other Fees

TRANSACTION FEES:

Square charges a fixed flat-rate fee for all credit card transactions - regardless of whether it's Visa, MasterCard, or AMEX. The fees are as follows:[1]

- Square reader or stand transactions (including credit cards, gift cards, and prepaid cards): 2.6% + $0.10

- Online transactions: 2.9% + $0.30

- Keyed-in or card-on-file transactions: 3.5% + $0.15

- Square Terminal and Register payments: $2.6% + $0.10

- Square for Restaurants (paid plan): $2.6% + $0.10

- Square for Retail (paid plan): $2.5% + $0.10

- Square Appointments (paid plan): $2.5% + $0.10

ACCOUNT FEES:

Square waives many typical account fees. With Square you pay:

- No monthly or annual fee

- No PCI compliance fee

- No startup fees

- No payment gateway fee

- No chargeback fees

- No early termination fee

- No monthly minimum requirements

HARDWARE PRICES:

Square provides your first swipe card reader free of charge. If you need other devices, the costs are as follows:[2]

- Additional magstripe reader: $10

- Contactless and chip card reader: $49

- Square Stand for iPad for contactless and chip: $169

- Square Terminal: $299

- Square Register: $799

Is the Square Card Reader Good?

The free Square card reader offers the ability to accept credit cards anywhere with your smart device. Here are some things to know about it:

- You can only accept swiped credit cards. Chip and contactless payments will require the chip reader.

- You can choose between the reader with a headphone jack and one with Lightning connector.

- You can send receipts via text or email. If you want to print receipts, you'll need to use a tablet and attach a receipt printer.

- Offline payments only work with the swipe reader. Chip and contactless payments require internet connection.

- No charging necessary. Just plug into your smart device.

- The card reader works with iOS 9.0 or later and Android 4.0 or later.

If don't want to wait to get the free reader shipped to you, you can buy it at a retail store. It costs $10, but Square reimburses the $10 to your designated account after activation.

What You Get With Square

When you sign up with Square, you get:

Free magstripe reader:

This allows you to accept swiped credit card payments. For chip and contactless payments (such as Apple Pay and Google Pay), you'll have to buy the chip reader.

Free Point-of-Sale app:

The free POS app is pretty powerful. Functions include emailing/texting receipts, setting discounts, issuing refunds, reviewing sales data reports, and managing inventory. See more details in section below.

Free Virtual Terminal:

Lets you enter card payments directly from your web browser for phone and card-not-present payments. You can also store credit card info so you can easily charge repeat customers.

Customizable dashboard:

On your dashboard, you can enter multiple locations, customize receipts, create custom categories, tax settings, and inventory. You can also set up a loyalty program, manage employees' hours and sales, and create custom reports.

Free online store:

Square comes with a free online store and eCommerce tools. You can build your own website with a variety of layouts and designs. It integrates with the Square POS so everything remains synced.

Square POS App Features & Tools

The free Square POS app has a full array of services. Features and functions include:

- Detailed reports and insights, such as what sells best, customer spending trends, and sales comparisons.

- Track each employee's time cards, breaks, and overtime.

- Grant different levels of access to employees.

- Send custom invoices (payments are considered online payments and will cost 2.9% + $0.30 per transaction).

- Update inventory, run reports, and receive low-stock alerts.

- Quick deposits within 2 business days. Instant Deposit will cost 1% per deposit.

- Sell and accept gift cards.

- Installment plan for customers, but you are paid upfront.

- Create and manage up to 300 locations under one master account.

- Integrates with many third-party apps and software.

Currently, you can only use the app on iOS and Android devices. It is not available on Windows, Blackberry, and Amazon Fire.

Keep in mind, though, that certain features in the app are only available on a tablet, such as an iPad. Most notably:- Printing physical receipts

- Printing physical kitchen tickets (for a restaurant)

- Displaying kitchen orders (for a restaurant)

Additional Add-On Services

You can also add more advanced tools for an extra fee. These include:

- Advanced employee management: See sales reports by team member and manage multiple wage rates. $35/month per location.

- Loyalty programs: Create loyalty programs and enroll and rewards customers directly from the POS. Starts at $45/month.

- Marketing: Create email and social campaigns and track results, all within your POS. Starts at $15/month.

- Payroll: Import timecards and pay employees and contractors. You can even offer benefits and 401k plans. Square takes care of tax filings. Employee payrolls are $29/month + $5/person. Contractor payrolls are $5/person/month.

Advanced Square Plans

For businesses with more specific needs, Square offers advanced industry-specific plans for extra cost. These include:

Square Appointments

For service industries such as consultants, spas, personal trainers, etc, this advanced plan helps you manage scheduling. Includes:

- Free booking site, or integrate with Instagram and Google

- Allows online appointment bookings 24/7

- Syncs with your own calendar

- Send automated reminders

- No-show protection by requiring pre-payment or cancellation fees

Free for individuals; Starts at $50/month for 2+ employees.

- Individual (free): 2.6% + $0.10 for swipe, dip, and tap

- 2-5 employees ($50/mo): 2.5% + $0.10 for swipe, dip, and tap

- 6-10 employees ($90/mo): 2.5% + $0.10 for swipe, dip, and tap

Businesses with over 10 employees can contact Square Sales team for pricing.

Square for Restaurants

Restaurants can benefit with Square's POS system specifically built for restaurant operations. There is a Free plan available supporting unlimited locations. Larger operations can choose one of the premium plans.

- Menu and table management

- Add on customers items and modifiers

- Auto gratuity

- Manage multiple restaurants

The paid plans have more features like custom floor plans, reopen closed checks, and live sales and close of day reports.

- Free: $0/mo

- Plus: $60/mo per location

- Premium: $299+/mo per location

All plans have the same processing rate of 2.6% + $0.10. For businesses with over $250k per year in card sales, custom pricing is available.

Square for Retail

New online or in-person businesses can start with the free plan. Expanding businesses have the option to sign up for one of the more advanced paid plans.

All plans include:

- Automatic customer profiles

- Unlimited inventory tracking

- Unlimited employee pass codes

The paid plans include more advanced features like cross location inventory, vendor and purchase order management, multiple wage rates, and more.

- Free ($0/mo): 2.6% + $0.10 in-person; 2.9% + $0.30 online

- Plus ($60/mo per location): 2.5% + $0.10 in-person; 2.9% + $0.30 online

- Premium ($299+/mo per location): custom processing rates available

For businesses with over $250k per year in card sales, contact Square for custom processing rates.

Square Customer Service

You have to be an existing merchant if you want phone support. You must complete an online form after signing into your dashboard. Once you complete the form, Square will provide you with a unique customer code that you use to talk to them.

Live phone support hours are from 6 AM to 6 PM. There is also email support if you don't need an immediate response.

Square also has an extensive knowledge database consisting of blogs, FAQs, videos, and community forum.

Square's customer service number is 855-700-6000. You need to be an active customer with a customer code.You can also email Square at help@squareup.com.

Is Square Safe?

Square takes these security measures to keep your payments safe:

- All security is implemented and maintained in-house by engineers.

- All products come out of the box with end-to-end encryption.

- Prohibits storage of card numbers, mag-stripe data, and security codes on client devices.

- Frequent hacker tests to identify potential vulnerabilities.

- Takes on the burden of PCI compliance for you.

- Requires 2-step authentication to prevent unauthorized personnel from hacking into your dashboard.

How It Compares

With Square, merchants pay a flat rate of 2.6% + $0.10 for swipe, dip, and tap transactions, 2.9% + $0.30 for online transactions, and 3.5% + $0.15 for keyed-in transactions. It offers a free mobile reader, web store, and virtual terminal. There is no contract and no monthly fee.

PayPal:

Square provides more features. It has a stronger POS with more advanced management features, such as scheduling, employee, and inventory management.

Square provides a free virtual terminal, where you can take keyed-in payments over the phone. With PayPal, you need to upgrade to PayPal Pro for $30/month for this feature.

PayPal does have an advantage if you sell online though. You can accept PayPal payments, which is popular with online shoppers. The system integrates with just about all eCommerce platforms. PayPal's mobile POS also accepts PayPal payments, which Square's does not.

Square | PayPal | |

|---|---|---|

Free Chip Reader - | ||

Benefits and Features | ||

| Customer Service | Phone, Email, Live Chat Support, Seller Community | Phone, Email, Live Chat Support, PayPal Community |

| Equipment | Free magstripe card reader; $49 for contactless + chip reader; Stand, Terminal, and Register available for purchase. | POS (Chip, Swipe, Tap), Marketplaces & Partners, Invoicing, Online Processing |

| Pricing Model | ||

| Swipe Rate | ||

| Online Rate | ||

| Monthly Fee | No monthly fees; $30/month for PayPal Payments Pro | |

| Keyed-in Transaction Fee | ||

| Deposit Time | Payments before 5PM PT / 8 PM ET is available the next business day | instant access to the funds in your PayPal account; Or instant deposit to your bank account for 1% fee or 1-2 business days for no fee |

| Chargeback Fee | ||

Stripe:

Stripe also charges a flat rate per-transaction fee comparable to Square's. Stripe started as an online-only credit card processor (though they do now offer a terminal for in-person payments).

Stripe is known for its advanced tools which allow for complete customization of your checkout experience. However, it's best if you have a built-in developer team. So it may not be ideal for small online businesses that don't need advanced customization.

It's also worth considering for large volume businesses, as they give a volume discount after $80,000 in monthly sales.

Square | Stripe | |

|---|---|---|

Free Chip Reader - | ||

Benefits and Features | ||

| Customer Service | Phone, Email, Live Chat Support, Seller Community | Phone (by request), Email, Live Chat, IRC |

| Equipment | Free magstripe card reader; $49 for contactless + chip reader; Stand, Terminal, and Register available for purchase. | Online Processing, Terminal, Stripe for Marketplace & Platforms, Billing Services (subscription & invoicing) |

| Pricing Model | ||

| Swipe Rate | ||

| Online Rate | ||

| Monthly Fee | ||

| Keyed-in Transaction Fee | ||

| Deposit Time | Payments before 5PM PT / 8 PM ET is available the next business day | 7-14 days after the first successful payment |

| Chargeback Fee | ||

Bottom Line

Square offers many benefits, operating as a full point-of-sale. They have the richest history in mobile payment processing and offer many additional features via third parties.

Square is a cheap, convenient way to accept credit card payments. There's no monthly fee and it offers lots of free features, making it worth it for new and small businesses. But, if you have heavy volume, could be considered 'risky,' or need phone support, you may want to look elsewhere.

References

- ^Square Pricing

- ^Square POS Hardware and Equipment

Write to Kim P at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Read Next:

|

|

|

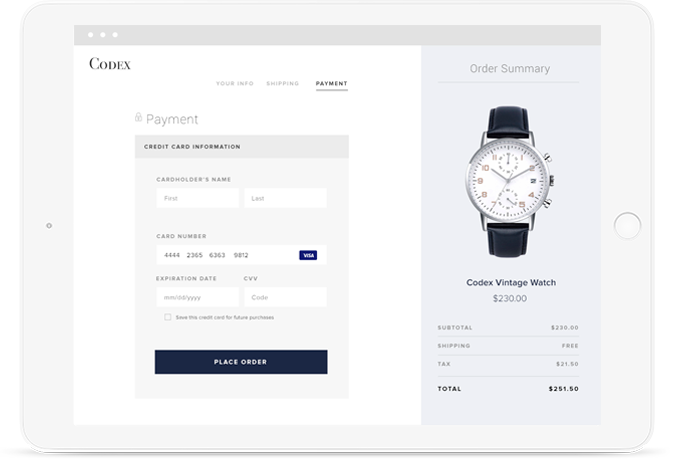

You probably already know Square as one of the most popular choices for taking credit cards using a smartphone. The Square POS system is also an increasingly common choice for in-store payments, especially for businesses with smaller transactions, like coffee shops. But it wasn’t until recently that the company rolled out an e-commerce option, called Square Connect.

What is Square Connect?

Use Square To Power Your Online Payments Calculator

The Square Connect API lets businesses with self-hosted e-commerce websites seamlessly integrate their site with Square to accept payments and manage business data on a web-based dashboard.

Before Square Connect, there wasn’t a way to take payments online with Square. The company’s online business customers had to use a different payment service to complete web store checkouts. Now, however, Square Connects’ e-commerce API eliminates the need for a third party online payment vendor. You’ll be able to handle all of your processing with Square, whether it’s in-store payments or website transactions.

The current version lets you:

- Accept e-commerce payments from your websites

- Manage customer data of online buyers, including cards on file

- Issue refunds

- Retrieve payment and refund information

Square boasts that you don’t need a lot of technical knowledge to enable online payment capability when you choose Square Connect.

Use Square To Power Your Online Payments Without

What is an API and how does Square’s work?

APIs enable different computing programs to “communicate” with each other to perform detailed and sophisticated tasks. Historically referred to as “middleware,” today’s sophisticated API’s integrate new features into existing applications (known as “plug-in API’s”). Companies that use API-enabled systems – like combined online payment and management products – usually must work with software engineers to program and manage the API.

Square says its e-commerce API all-in-one payment and data processing suite for face-to-face and online transactions allows you to accept, then monitor, all credit card payments with one simple web dashboard. According to the company, there’s no need for sophisticated software development engineers, which could be a cost savings for you. Pushing simplicity is in direct contrast to competitor Stripe, which prides itself on being a “developer’s choice.”

Why is Square offering the API?

Square is hoping to successfully compete with the leading payment web payment providers, including Stripe – an online-only service – and PayPal. Previously, Stripe and Square were not direct competitors, as one only offered online payments and one only offered in-person payments. PayPal offers both, but is much more well-known for its online payment options. (PayPal’s nearly 20 year success gives it the largest online payment share.) Moving into online payment acceptance now pits Square firmly against those two companies. Square’s new API also comes close on the heels of PayPal’s EMV card reader release, which targets Square’s large reader market share.

Square’s current clients – primarily those who use the card readers and POS systems – don’t necessarily want to deal with the IT and programming set-ups that are required with most e-commerce API’s. Square is hoping that customers who already appreciate the simple mobile payment and POS options will also find the simplicity of the ecommerce option appealing.

Who is Square’s API good for, and why?

PayPal, Stripe, and many other API providers have reputations for creating “developer’s platforms.” These are primarily built for clients that can afford to maintain an IT/software development staff or are very tech-savvy and can implement more complex payment solutions on their sites.

But Square markets the Connect API as a user-friendly, “you don’t need to be (or hire) a developer to use our platform,” solution, which makes it a viable option for those who don’t want to bother with complicated programming or don’t feel comfortable programming a payment integration.

What does it cost?

Use Square To Power Your Online Payments Online

Square Connect charges a fee of 2.9% +$0.30 for each payment. This puts them at exact the same pricing as Stripe, PayPal, and Braintree.

While those four ecommerce payment providers have the same pricing, don’t make the mistake of thinking that every processor will charge that, or that online payments are a fixed cost. Depending on your volume and business specifics, you may be able to get lower pricing for online payments.

Check what pricing you’re eligible for at CardFellow.

Additional Square Services

Use Square To Power Your Online Payments Bill

In addition to Square Connect, the company offers services like invoicing, payroll, inventory management, and more. Anoptional Square for Retail package includes advanced reporting features. It also allows you to take advantage of services designed specifically for small businesses in retail businesses.

Other Options for Taking Online Payments

Although only a few names tend to get the media attention, there are actually a lot of options for taking payments online, with varying degrees of technical knowledge required. In fact, most processors nowadays have ways to get you set up to take online payments. If you want to know exactly what pricing you’re eligible for, use our price comparison tool to see the real costs of processing with different ecommerce payment processors.